What personal bank loan is right for you?

If you’re looking having a personal bank loan and want a large label in the money, you could potentially inquire when the Investment One to unsecured loans try an option. The fresh small response is zero. There aren’t any Financial support One signature loans. You will find, not, many other choices. It is an issue of finding the consumer loan that meets the state ideal.

Personal loan choice to help you Financial support One to

Here we’re going to shelter alternatives so you can Capital You to definitely personal loans and help you no inside towards the version of loan you are looking for. An unsecured loan is different — no financing is certainly one proportions suits all the. It may take a little effort to discover the prime financing, but it could be worth every penny.

Finance companies

When you are the kind of user who wants your entire accounts in a single put, a bank may offer the best alternative to Financial support You to private financing. Actually, it might was in fact the reason your sought out Financing That personal loans in the first place. Envision exactly how easy it might be to have their family savings, bank account, mastercard, and private financing all-in the same place. If you have a concern from the these accounts, you know who to mention. You can quickly learn the fresh new bank’s on line choice and you may supply all your financial suggestions any time.

Marcus is an internet lender that might build an excellent private loan alternative. Marcus by the Goldman Sach’s savings account try aggressive, therefore the bank has the benefit of sophisticated signature loans. With low interest and versatile financing quantity, it sticks to the slogan out-of: No charges, actually ever. When you have good credit, it is really worth a glimpse.

Credit unions

Credit unions are a good replacement for Money You to signature loans. Such a financial, joining a credit connection you certainly will enable you to get checking membership, checking account, charge card, debit card, and personal loan in one place.

At exactly the same time, a card union is far more probably see you due to the fact a great person that have a different set of situations. In a nutshell, you aren’t just lots. What if you’re self-working and you can secure an uneven earnings, otherwise your online business fund apparently use up a big section of your earnings. Perhaps you are in the process of boosting your credit history. Whichever your role, financing administrator at a card union is much more probably comprehend the dilemna.

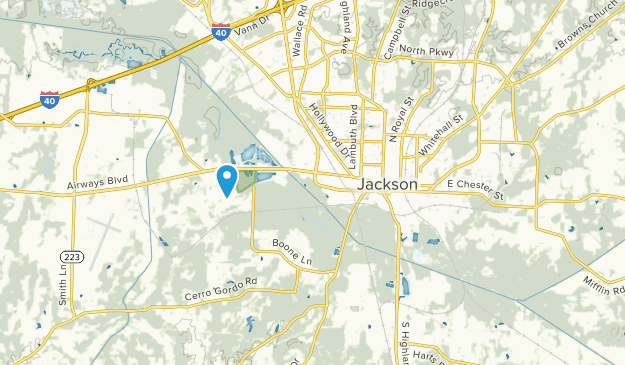

With 314 locations all over the country, Navy Federal Credit Union is the largest credit partnership about nation. Navy Federal also provides some rather competitive signature loans. For folks who otherwise anyone on your instantaneous family features served in the this new army, is assigned to the new Agencies off Shelter, or is an element of the defer admission program, you will be entitled to five different types of signature loans having high pricing.

On the internet loan providers

Seeking another replacement Financial support You to unsecured loans? On the web lenders get amaze you. You earn all the comfort you’re hoping for out-of Funding You to personal loans, and a quick approval processes. For folks who qualify, it takes no time before you can get a loan give — such as the interest rate and cost term. Due to the fact on line personal bank loan loan providers jobs with faster overhead, the eye cost are going to be truth be told reduced. And you may if or not you have advanced level credit otherwise poor credit, there was a personal bank loan for everyone.

One of the most recent preferred try SoFi, with many of your own lower rates of interest and you can individual-amicable policies about personal bank loan organization.

Any type of alternative you select, one which just pick possibilities in order to Money That personal loans, take steps to boost your credit rating. You could begin by paying down financial obligation. Another great cure for improve credit history is to view your credit history for errors.

Focusing on your credit score pays — virtually. Advanced level borrowing from the bank can present you with access to low interest personal loans and save you hundreds if you don’t thousands of dollars.

Brand new “right” personal bank loan depends on some things, together with your credit score and you will credit score. It also hinges on the arrangements on mortgage and also the sort of loan you would like. A consumer loan is one of well-known particular personal bank loan, however, a secured mortgage is actually a much better option for some people. If you take away a secured financing, you will have to developed a equity, such as your home otherwise auto. This may imply you be eligible for ideal financing terms and conditions, however your guarantee is at chance for many who skip your own month-to-month payment.

The great thing about personal loans is the fact you will find scarcely restrictions about precisely how you employ him or her. Such, particular unsecured loans is actually tailored having debt consolidating. The best debt consolidation loans will save you currency from the decreasing the rate of interest and you may/or payment. Equilibrium transfer handmade cards will additionally be well worth exploring. Almost every Austin installment loans no credit check other fund will be suitable to invest in house home improvements or shell out to possess scientific expenses.

- The lending company fees a low-value interest and low fees — if any charge after all.

- The borrowed funds cost identity works for you. It should be for a lengthy period to save the newest payment down, however, small sufficient to allow you to pay the mortgage regarding rapidly.

- The lender is not difficult to work well with and you may people you can believe.

After you discover financing one to ticks out of the three packets, you are focused to locating a solution so you can Investment You to personal loans.

You’ll find several huge finance companies that don’t bring personal loans, possibly just like the margins are too narrow and/or risks of signature loans are too high.