Exactly how a lender Analysis a business Financing Request and also the 5 C’s away from Credit

One which just actually ever fill out a formal loan consult into financial, its likely that you have spent long planning. 1st step might possibly be deciding how much cash you would like, exactly how you will use such fund and you can what sort of mortgage most useful suits you. Which have a solutions to questions that all prospective loan providers query have a tendency to help you browse the fresh new credit process with full confidence. Next you ought to assemble all paperwork needed for your loan application, similar to this selection of all you have to make an application for a TD Lender Small company mortgage. Various other step that will help you achieve a positive benefit to possess your loan consult are facts exactly what lenders will look out for in providers financing people. Therefore even though you do not require that loan instantaneously, developing the five C’s of Credit may help ready your team to achieve your goals.

Knowing the 5C’s out-of credit

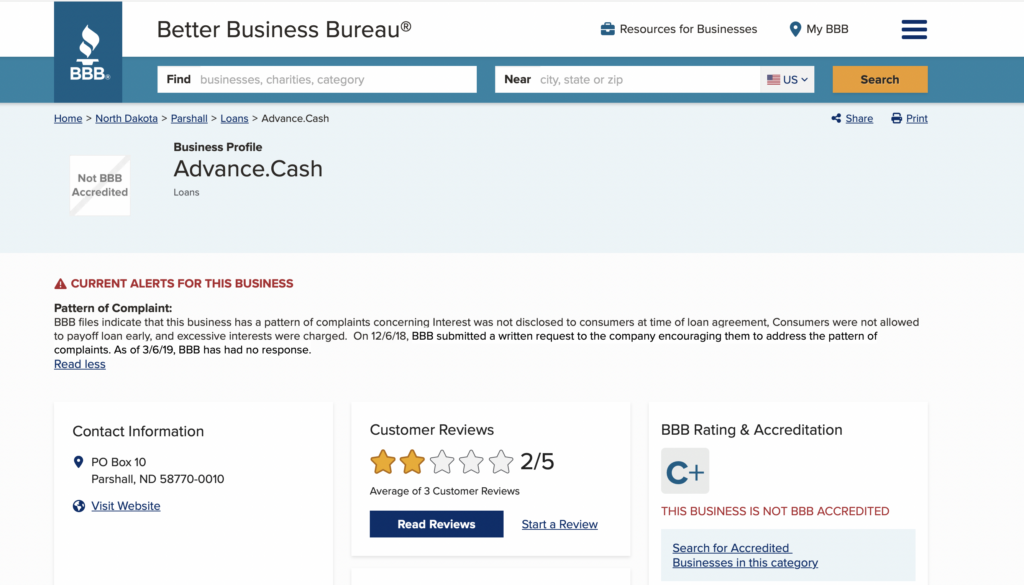

Character: Profile Cleveland installment loan bad credit no bank account is the determination to take on financial obligation and you can commit to cost toward arranged words along with other loan providers. This information is tend to determined by a glance at their Borrowing from the bank Bureau accounts which can reveal each other your online business and private borrowing history. When your business is new, your own personal credit score are certainly more heavily depended up on so it is important to sometimes remark your credit history for reliability.

Specific to own-finances groups can get guarantee short credit repair choice to possess an up-top percentage. Bear in mind you’ll find very important things you can do on the, at no cost, by performing yourself into the borrowing from the bank bureau. Below are a few 100 % free tips toward Federal Basis having Borrowing from the bank Guidance getting a way to make it easier to resolve your very own credit rating.

Capacity: Ability will be your capability to take on credit. Banking companies usually have fun with International Personal debt Service Coverage Ratio (GDSCR) to evaluate their convenience of taking on personal debt, and each financial possess their own GDSR calculation procedures. Typically, GDSCR comes with providing your organization earnings and you can dividing they by your annualized costs and picking out a ratio in advance of considering yet another mortgage request. When your proportion is over you to definitely, it indicates your enterprise is taking in additional money versus money gonna provider the debt. A proportion out of quicker one form your company is perhaps not getting adequate bucks and it may end up being time to reconstitute or spend-away from personal debt.

- Your organization income range from net gain, depreciation, amortization and you may appeal establish offs

- Your annualized costs range from payments to have present financial obligation (dominating and you can focus)

- In times from financial suspicion, you could find finance companies increasing the GDSCR proportion to stop high risks of non-payments. You might ask your banker exactly what the regular ratio they’d want to see from a debtor

- To do this type of computations, you will need right up-to-time economic statements and you will/otherwise taxation statements. Should you choose new data your self, score an extra opinion by the Banker otherwise CPA

Capital: The bank have a tendency to evaluate the cash status of team and you may what you can do so you can liquidate most other possessions if it was in fact must help your loan obligations whether your business strike a crude spot.

The five C’s from Borrowing: Just what banking institutions discover after they feedback your company loan demand

Conditions: This tends to become a very industry specific data of your problems that manage prompt stability otherwise pose a threat so you can repayment of mortgage obligation. That have a well thought out business plan that identifies the risks and mitigations support your own lender discover your preparedness to deal with these challenges. Such, brand new TD Lender Small company Covid-19 Questionnaire discovered that 81% out-of people did not have an urgent situation package ahead of COVID-19 2020 shutdowns. Although some companies surveyed managed to rotate to meet this type of this new challenges, more than 69% acknowledged the need to prioritize strengthening steady financing and money reserves and you can increasing its business model autonomy to raised prepare for coming crises. The individuals businesses that been able to pivot directed in order to virtual meetings/visits, delivery-mainly based consumer fulfillment, ecommerce and online conversion process given that important factors to help you fulfilling COVID-19 demands.

Collateral: Collateral refers particularly as to what possessions your business is ready to pledge to help you safer financing. Small businesses usually are requested to incorporate your own be certain that in the event your business is unable to pay the loan. Most finance companies will require people who have more than 10% control to include a personal be sure, it is therefore important one to citizens have updated taxation statements as well as have analyzed their private credit history at that time they would like to search providers financial support.

You simply will not necessarily need to have finest ratings throughout out-of the five C’s but obtaining best equilibrium will make you significantly more competitive whenever a lender takes into account your application. Remember, you are together with a decision originator regarding credit process. You’re in charge of what type of credit is practical getting your targets. Including examining loan providers as well as the choice they supply, and thinking of the financing consult remaining the 5 C’s at heart.