Medical practitioner Funds: Up to a hundred% Capital for Doctor Mortgage loans

Doc mortgages are now being offered by a growing number of banking companies and you will low-financial loan providers, making it a very good time discover a health care professional loan.

Doctors is actually doctors who have worked hard to reach its needs. Unfortuitously, it hard work possess more often than not have a large financial and you can debts. This will limitation good physician’s possibilities with regards to delivering a traditional home loan. Doctor finance, roughly-called doctor mortgages, have stepped in to address it need, taking upcoming physicians toward money they need to funds its scientific degree.

What is actually a health care provider loan?

A doctor mortgage are a loan system tailored specifically for new book monetary reputation from a health care professional. They provide less limits than a normal financing, according to research by the premise that borrower enjoys large money or strong coming generating possible. This will help physicians and you can medical pupils overcome particular hurdles they could deal with that have old-fashioned financing, including:

- Very little depending credit

- Zero high dollars reserves (age.g. downpayment)

- Not yet become work

- Crappy financial obligation-to-income proportion because of college loans

Inside the antique credit scenarios, a health care provider can often be recognized as a card risk, mostly the help of its high financial obligation-to-earnings proportion. Banking companies has tailored these financial products alternatively that acknowledges the importance physicians results in so you can a loan company on long haul.

The ingredients from a health care professional mortgage

Whenever you are things can vary in one financial to another location, allow me to share area of the section you to definitely tend to normally see in a doctor financial:

Lowest to help you no advance payment criteria. In the event the mediocre financial commonly is sold with down-payment criteria since the higher just like the 20% off cost, doc mortgages can be wanted a lot less. In a number of scenarios, finance companies might even promote doctors one hundred% funding no money off.

Casual documents standards. Conventional mortgage loans, especially as the financial crisis, encompass thorough earnings documents and more than of the time banking institutions require W-2 earnings. Meanwhile, doctors trying to get a health care professional mortgage might only need certainly to fill in closed away from emails otherwise a work bargain proving you to its a job can start within the next three months. Self-operating physicians, too, are able to find more stimulating earnings verification tips Riverside savings and installment loan that can n’t need add as much numerous years of tax returns as they you are going to that have a normal loan.

No PMI. Old-fashioned financing feature called for PMI, otherwise private mortgage insurance rates. That it safety to have lenders is consolidated from the aftermath of the 2008 drama from the government height. With a good physician’s financing, there’s absolutely no required PMI, however, there I can help save you thousands of dollars.

Convenient consideration to have figuratively speaking. A beneficial healthcare provider’s financial obligation-to-income ratio is oftentimes one of the most problematic aspects during the a software for the underwriting procedure. This can be generally speaking due within the highest region on large student loan obligations medical professionals undertake to pay for university.

Inside the traditional credit problems, a financial institution you are going to see so it because the a barrier to recognition. Having doc funds, a bank takes into consideration one a physician can get a good large amount of student personal debt and you can, hence, utilizes much easier conditions with regards to factoring financial obligation towards applicant’s full viability.

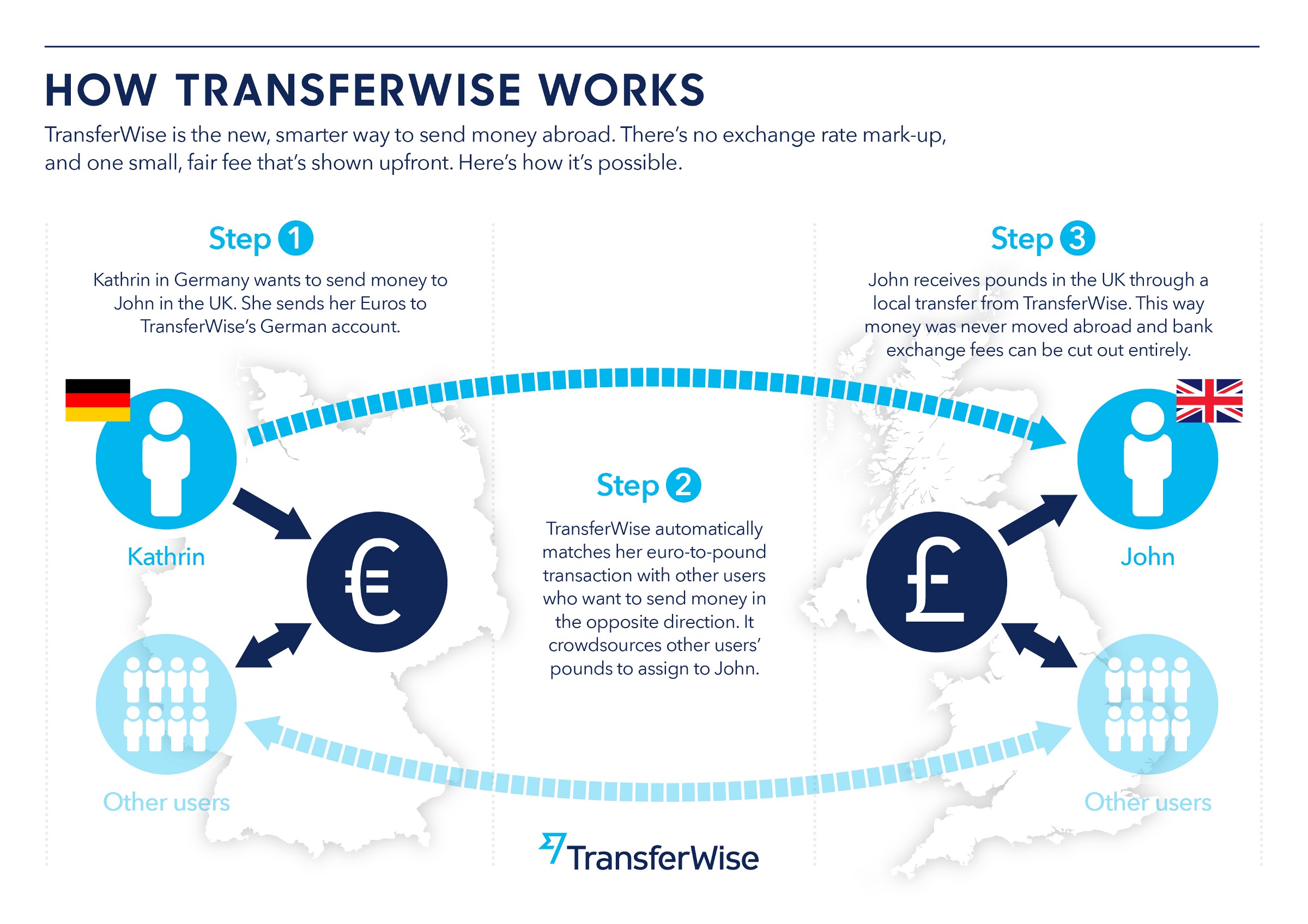

Exactly how medical practitioner loans works

Medical practitioner home loans try similar in many areas so you can old-fashioned mortgages. It differ about large experience in this he or she is tailored to your certain demands from doctors and other large-money positives.

This type of physician loan applications require no personal mortgage insurance towards the cause that lender features protections in position based on a great healthcare provider’s higher money and you may credible a position. This type of mortgage loans and additionally eradicate amortized student loan money once the something inside the DTI proportion computations, acknowledging all the way down, income-situated repayments as an alternative. Off repayments commonly needed, sometimes. Such finance work in this way once the bank needs to benefit of a great strong consumer experience of a health care professional in the long run. As a result, the lending company are willing to generate apartments through these products to help you professional people.